enrollment

Prior-Prior-Year update: 13 ways to maximize early filer conversion and yield rates this winter and spring

This is part two of a two-post series on opportunities associated with the new FAFSA PPY (Prior-Prior Year) regulations which went into effect in fall 2016. See part one.

How well is your enrollment team tracking the impact of FAFSA PPY? Are you maximizing your early filer conversion and yield rates?

In September of 2015, the Department of Education announced that we would be moving to Prior-Prior Year (PPY) or Early FAFSA Filing for the fall 2017-18 academic year. This change was largely supported by higher education institutions, policy groups, and lawmakers with a number of goals in mind:

- Simplify the aid application process

- Increase FAFSA completion

- Increase the accuracy of the FAFSA

- Provide families an earlier and more accurate idea of their anticipated financial aid and college costs

- Provide all students more time to plan and make informed enrollment decisions

And of course the ultimate goals: greater affordability and greater access for students.

Now that PPY and fall 2017 recruitment are well under way, it is important to review the early results of FAFSA PPY and identify specific strategies to maximize filer conversion and yield rates.

Early FAFSA PPY filing rates: What the data show

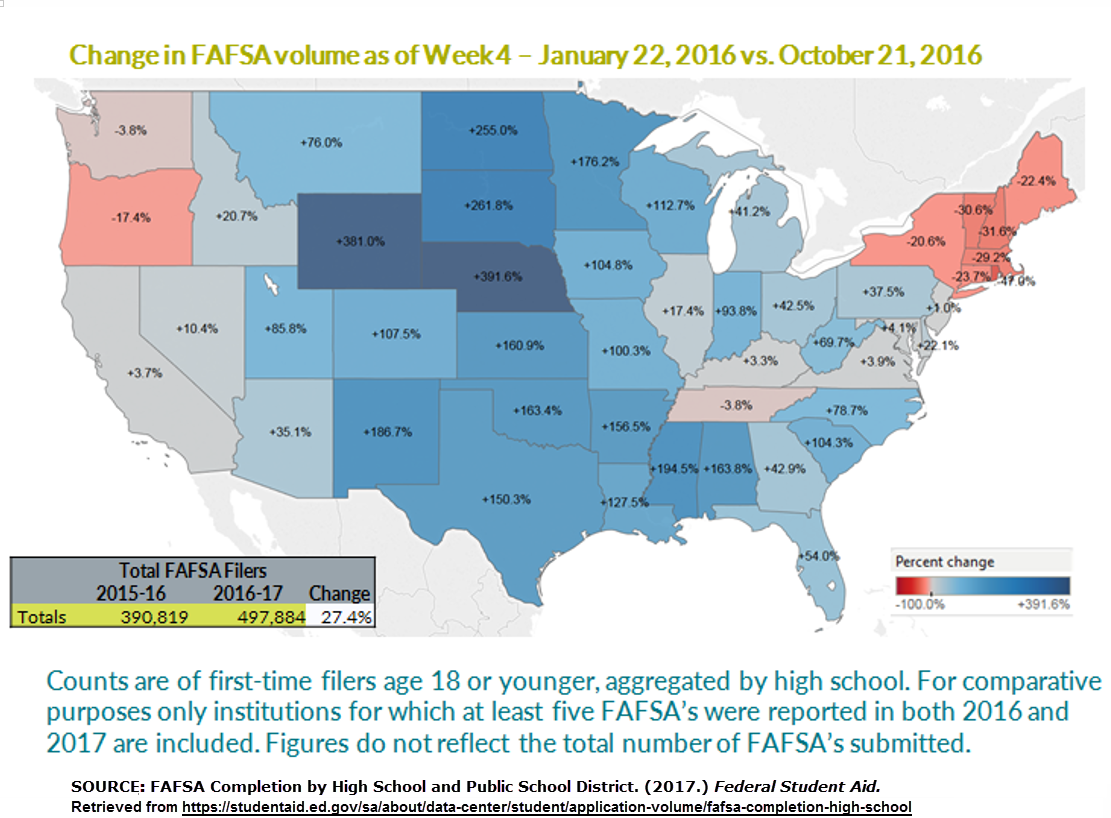

FAFSA PPY filing started off quickly in comparison to previous years but slowed during December. In the absence of previous filer rates for October, the Department of Education in its reports decided to compare FAFSA filing rates from 2016 to 2017 by week. For example: Week 4 of 2017 included filing data through October 21 compared to Week 4 of 2016 which included data through January 22:

Above, we can see the first 4 weeks of filing this year were exceptional with 497,884 filers compared to 390,819 in the previous cycle, a 27.4 percent increase. The FAFSAs submitted were also more accurate, with the number of rejected ISIRs dropping by 12.6 percent in the first month. This translates to a 34.1 percent increase in the number of completed FAFSAs submitted during the first four weeks of the FAFSA cycle for 2017.

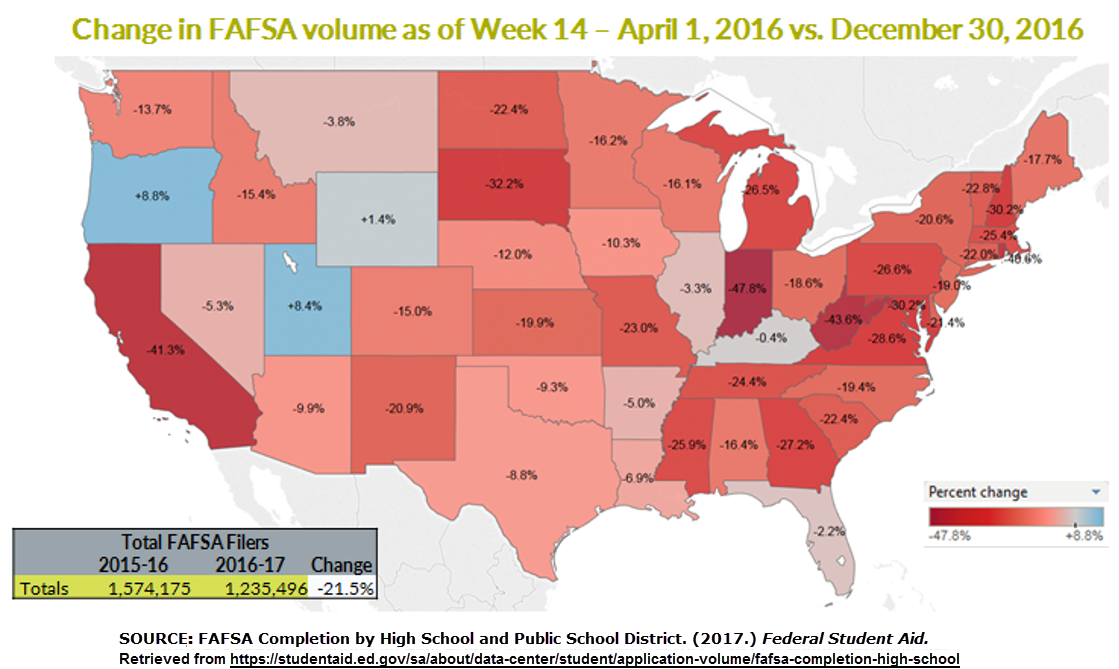

However, following the results of the first four weeks we have seen filer rates slow down considerably:

The reduction we are seeing is largely related to filing deadlines for many institutions which begin February 1 and run through March and April. Keep in mind that December 30 results or Week 14 is being compared to April 1 of last year, amounting to a drop of 21.5 percent behind last year in the volume of FAFSA’s submitted.

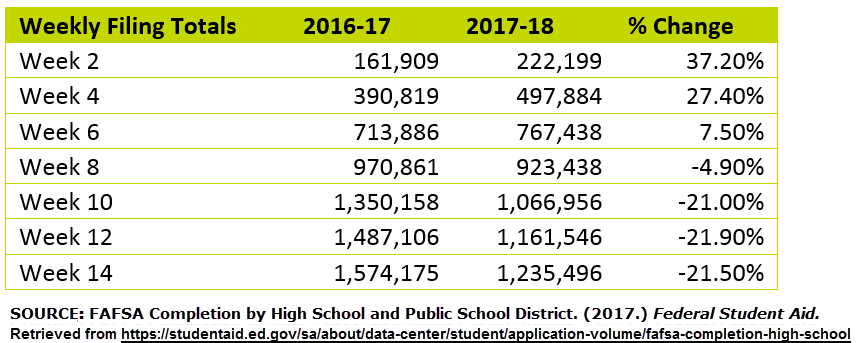

Our forecast: FAFSA volume will meet or exceed last year

While early results have slowed, the results of FAFSA PPY are still positive with completion rates improving and strong volumes of filers. As we move through February and March we expect to close the gap in filing volumes. The table below provides a bi-weekly look at FAFSA filing volumes through December 30.

Taking a closer look: Institutional FAFSA filing and the impact of PPY

With filing volumes strong, what are our partner institutions now seeing in their FAFSA filing data and results? For those of you unfamiliar with RNL Advanced FinAid Solutions (AFAS), there is a weekly tracking component which provides our campus partners with reporting on their first-year and transfer results for admitted students. These reports cover a wide array of data from academic quality, discount rate, net tuition revenue, FAFSA filing, need and merit-based aid, and the distribution of students by academic and need level. As of the first week in January, 40 percent of our campus partners have begun tracking their fall 2017 data. A majority of these institutions are private institutions. Below you will find a few key data elements – we encourage you to compare your early results:

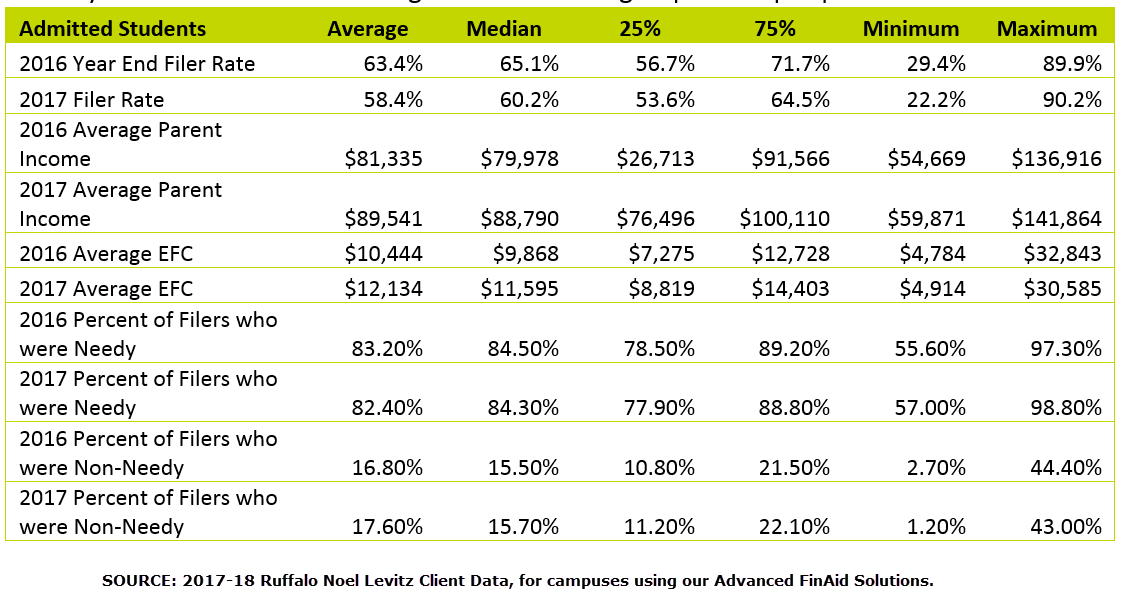

- FAFSA filing rates: The median FAFSA filing rate for admitted students in 2017 for our campus partners stood at 60.2 percent with the middle 50 percent range at 53.6-64.5 percent. While we don’t have filing rates this early for campuses in previous years, the final median FAFSA filing rate for these institutions was 65.1 percent. Hence, many campuses are well on their way to record filing rates for 2017.

- Average parent incomes: One of the primary goals for FAFSA PPY is to improve access. In this first cycle for PPY this could be a concern especially in states where there is an early filing deadline for state need-based aid eligibility. As of the first week of January, the average parent income for admitted needy students for 2017 was $89,541 which compares to the average parent income for needy students in 2016 of $81,335 – a 10.1 percent increase in parent income for our early needy students. These initial data suggest that the families who have filed earlier in the process actually have greater resources and that some of the neediest students have not taken advantage of early filing.

- Average EFCs: With the increase in the average parent incomes comes an increase in family contributions. The early need-based filers for 2017 have an average EFC of $12,134 compared to $10,444, a 16.2 percent increase in EFC. The middle 50 percent range is $8,819-$14,403, with this variance based on institution type, selectivity, and location.

- FAFSA filers by need and non-need eligibility: Last year, 83.2 percent of FAFSA filers were eligible for need-based aid. This year 82.4 percent of FAFSA filers were eligible for need-based aid. Based on the increase in average incomes and EFCs for needy students, we expected an increase in the number of filers who were not eligible for need-based aid. What we are experiencing is a similar volume of filers who are needy – but the distribution of those students by need level has changed with more students falling into lower need levels.

Below you will find a table detailing the data for our group of campus partners as of January 6, 2017:

13 strategies to maximize filing and yield rates through FAFSA PPY

As institutions implement recruitment plans, we’re all looking for additional strategies to impact the final enrollment results for fall 2017 or for additional strategies to develop for fall 2018. Below you will find strategies designed to impact filing and yield rates as we move through this year:

- Send financial aid awards to students who have been admitted and have filed the FAFSA. Our campus partners sent financial aid awards as early as mid-October this year though most began to send awards in November and December. If you have not sent financial aid awards to admitted FAFSA filers, you’re missing an opportunity. Take advantage of FAFSA PPY – if a student is admitted and completed the FAFSA, send the financial aid award so the student may begin to make a final decision.

- Provide financial aid consultations for students who have been admitted and have received their financial aid awards. This is the admission or financial aid officer’s opportunity to have the cost conversation with students and families. Help them understand the affordability of the institution and the investment the institution is making in the student.

- Develop specific yield communications for earlier FAFSA filers. Yield communications are designed to drive decisions from prospective students. These communications should target academic quality, affordability, student engagement, and return on investment topics, and have a call to action to enroll, register, or visit campus.

- Begin tracking your admission and financial aid data earlier in the season. Many of my partner institutions have commented in tracking calls that “we’re comparing apples to oranges” this year. This is why it is critical for you to track your results so that next fall you will be back to comparing apples to apples.

- Identify candidates who have filed the FAFSA and have not been admitted. Staff should work to admit, complete, or engage the students to apply.

- Identify FAFSA filers who have not visited campus. The campus visit is still the best predictor of enrollment success so identifying students who have raised their hand via the FAFSA will provide additional focus for admission and financial aid officers to reach out and encourage campus visits.

- Identify applicants and admits who have not filed the FAFSA with your institution. While many students have filed the FAFSA there are still many students who will be filing the FAFSA during the next few months. Or there are students who may have filed but have not sent the results to your institution. It is critical to identify non-filers for your admission staff so they can follow up with the families to encourage FAFSA submission.

- Prioritize staff phoning. I believe this has been one of the most difficult challenges of FAFSA PPY. Traditionally, admission staff focused their time in November and December on applicant cultivation. With the onset of PPY, admission staff needed to divert some of this time to financial aid follow-up. Encourage your staff to strike a balance between application generation, application completion, and yield communications.

- Student phone teams can be a great resource in balancing the staff phone contact challenges. Student phone teams can fill the void with phone calls focused on visit events, incomplete applications, etc.

- Identify melt reduction strategies for your campus. One way to improve fall enrollment is to reduce the melt of students who have deposited to your institution. These strategies could include early registration, early orientation programs or events, housing assignments, etc. Each step or process a student completes towards enrollment solidifies the student’s enrollment in the fall. Work through your checklist for enrollment – which items could a student complete earlier in the process that will more fully commit them to your institution?

- Early financial aid nights. Financial aid nights are an important strategy to assist families and students with FAFSA filing or to discuss their financial aid awards. While some of the fall financial aid nights were not as successful as we would like, I believe over time these will be an important step in helping improve the access of the FAFSA for all students. I would encourage any campuses to schedule these events especially in urban or rural areas to more fully assist families with this important process.

- Schedule early yield events. Yield events are designed to engage and connect admitted students to the institution and to other prospective students. One benefit of PPY is the ability to provide all the necessary information for a decision earlier in the process. Scheduling early yield events for all students or scholarship events for the recipients is a great way to boost yields for early admits.

- Six months of yield cultivation. One challenge of PPY is that there will be some students who are admitted in October and still do not make their final decision concerning college until May 1 – that could be 6 months or more of yield work for admission and financial aid staff. Staff need to stay connected to the students and families because there will be some institutions who do not get their financial aid award out until late in the process. As the staff progresses through the spring, keep in mind the key yield messages to review: affordability, academic experience, academic quality, outcomes, career advancement, study abroad, etc. Look for other messages tailored to specific students: fine or performing arts, athletics, leadership and service, etc. Don’t forget about outreach from academic departments, alumni, or current students.

Build your enrollment for 2017 and beyond by converting and yielding early filers

We hope you find this article helpful as you work at building enrollment in 2017 and subsequent years. Our research and regular visits to campuses show us that many institutions have substantial, untapped opportunities to recruit early filers and award financial aid more effectively in the new Prior-Prior-Year Environment.

Questions? Want to discuss your Prior-Prior Year strategy with an expert?

Call 800.876.1117 or email me to confidentially discuss any questions you may have regarding how your institution is working with early filers to improve their conversion and yield rates. We’ll be happy to share with you how campuses similar to yours are responding as we listen carefully to your situation.